Financing Receivables - A quick way to relieve cash flow stress!

Financing Receivables can get you out of a cash flow bind in a hurry. Since factoring companies aren't financial institutions, they don't require the rigorous application process to get cash for your immediate business needs.

Banks are in business to loan you money and they often don't really care too much about your accounts receivable - other than that they are current. They aren't interested in financing receivables, they lend money based on your physical collateral that includes the age of your business, the amount of equity you have in your business and how your company is performing from a financial statement point of view. All of this means that you are going to be working through a lot of paperwork and your loan officer usually doesn't have the final authority to approve the loan - they can only recommend to their superiors at "the next meeting" that they loan you some money.

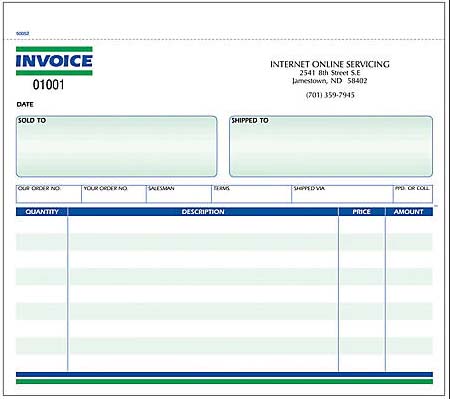

Contrast this with how a factoring company operates. You ask them if they would like to buy your outstanding accounts receivable invoices for less than the amount that will be paid. Based on your customers, not your business, they determine if they would like to buy your invoices at a discount. This process doesn't take very long and you can have cash in hand within 24 to 48 hours.

Factoring will probably cost you more than taking out a loan - after all the only "collateral" is the invoice so there is a fair amount of risk to the factoring company. But you can get cash in hand to make your payroll or keep vendors happy so that you can get the supplies you need to keep your business viable.

To check if your receivables qualify to be factored, take the time to fill out a brief online factoring form.